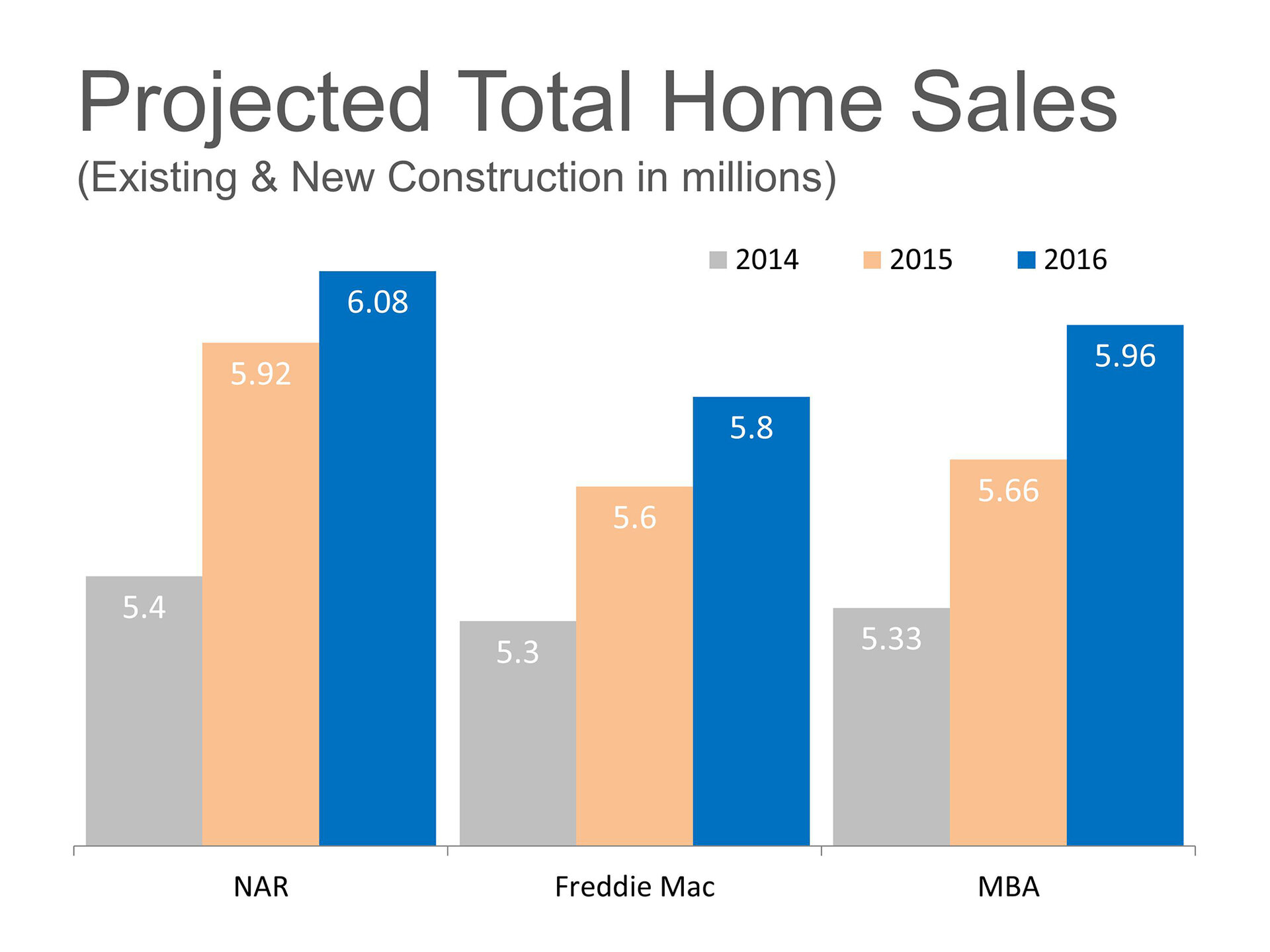

If you are planning on selling your home over the next two years, now may be the time to act. Demand is high, supply is low and many homeowners are benefiting from an almost auction atmosphere with several buyers fighting for their house in the current multi-bid environment. Higher prices and less stringent contingencies are making it easier for the seller and their family. However, there may be more (and better) competition about to hit the market in the form of newly constructed homes. This may put an end to the buyers’ frenzy over the limited inventory of existing homes which has been below normal levels for over a year. According to the latest report from the National Association of Realtors (NAR), the forecast for new housing starts and sales will increase significantly over the next two years:

NAR is forecasting 1.1 million new housing starts in 2015, jumping to 1.4 million in 2016.

New home sales are projected to increase from the 437,000 in 2014 to 570,000 this year and 720,000 in 2016.

Bottom Line

In major urban areas across the country, building cranes are again stretched across the city skyline. In many suburbs, you can again hear the thumping of a carpenter’s hammer in the background. Those are the sights and sounds that inform us that it may be time to sell.

By: KCM Crew

Follow Us!